Jio payment bank 2021 | Jio payment bank customer care | Jio money

Table of Contents

Reliance Industries Limited was granted in-principle approval by the Reserve Bank of India (‘RBI’) to establish a new Jio payment bank under the Banking Regulation Act, 1949.

Jio Payment Bank is now fully live. The Reserve Bank of India (RBI) said that Jio Payments Bank has begun its banking services

It then partnered with the State Bank of India to support this ambitious initiative of building Payments Bank capabilities for every Indian and accordingly, Jio Payments Bank Limited, was incorporated in November 2016.

With the track record of the Reliance Group of leadership in chosen areas of businesses and large scale roll-outs, the Payments Bank initiative is seen by Reliance as a significant opportunity to make a transformative impact on India’s financial inclusion landscape to lead and co-create an eco-system to provide accessible, simple and affordable banking solutions to all constituents of our country – especially the financially excluded, to digitise payments and to act as a catalyst towards a cashless society.

Jio Payment Bank Information launch date

Jio payment bank IFSC code

IFSC Code: JIOP0000001

| IFSC Code | JIOP0000001 (used for RTGS and NEFT transactions) |

|---|---|

| MICR Code | NA |

| Branch Code | 000001 (Last Six Characters of IFSC Code) |

| Bank | Jio Payments Bank |

| Branch | Rtgs-Ho |

| District | Navi Mumbai |

| State | Maharashtra |

| Address | Reliance Corporate Park, Ghansoli, Navi Mumbai, Maharashtra, India |

| Phone No. | 1800 891 9999 |

Jio payment bank interest rate

Jio is offering an exceptional interest rate to you if you deposit your amount with them.

You will be able to receive 4% interest on your money from jio payment bank.

Jio payment bank share price

Jio had not yet launched its IPO in the Indian market yet.

So you have to wait for some time to buy jio payment bank shares in Indian stock market.

Jio payment bank app download

Users with Android Smartphones and IOS can easily Download Jio Payments Bank App by visiting the Google Play Store and app store simultaneously.

You just need to visit the store on your smartphone and type jio payment bank over it.

Jio payment bank launch date

As we all know that Airtel and Paytm had already had their own banks and are running successfully, Jio has now stepped into the Payment Bank market and they’ve finally launched their Jio Payment Bank in April 2018.

All this is done to have an Indian own bank to support people and keep the money of Indian people in safe hand.

Benefits of jio payment bank

There are many benefits of jio payment bank over other competitor traditional banks and their benefits.

Jio is trying to attract people through their brand and providing ultimate benefits to customers so that they will have huge customer base:-

- Opening an account in jio bank is a matter of few minutes only.

- It works with all telecom partners and on all network from 2G to 5G.

- Jio is offering coupons and promo code on all different brands for their customers to avail on regular basis.

Jio Payment Bank Debit Card

No, the company not yet launch its jio debit card.

Jio Payment Bank Debit Cards will be issued by Jio Payments Bank in the coming future after the end of this epidemic covid.

Jio payment customer care number | Jio payment support center

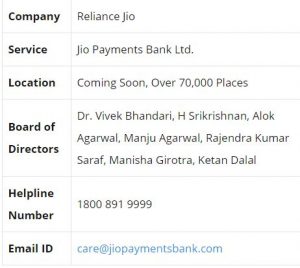

You can contact on the number for any query related to Jio payment bank – 1800 891 9999

or you can email them at- care@jiopaymentsbank.com

Jio payment banks head office- 5th Floor, D-Wing, TC-22, Reliance Corporate Park, Ghansoli, Navi Mumbai – 400701

If you haven’t received a feedback for your concerns or if you are not satisfied with the response received from the above mentioned access channels, you may escalate your concerns to our Head – Customer Service by sending an email at Headcustomercare@jiopaymentsbank.com. Please mention the reference number provided to you in your earlier interaction for speedy resolution. We will get back to you in 10 working days.

Jio payment bank fees and charges

| Bank Account | Details |

|---|---|

| Minimum Balance Requirement | NIL |

| SMS Alerts | NIL |

| Interest Rate on Savings Account | 3.5% per annum, payable quarterly (Effective from 9th September 2020) |

| Service | Fees/Charges (Rs.) |

| Account Opening | Free |

| Load/Add Money (Mobile App) | Free Unlimited |

| Cash Deposit (SBI Branches) | Rs. 2.5 per 1000 deposited with minimum of Rs. 11 per transaction plus applicable GST |

| Bill Payment (BBPS) | NIL |

| Funds Transfer | Fees/Charges (Rs.) |

| Within Jio Payments Bank (Mobile App) | Free Unlimited |

| From Jio Payments Bank to another Bank (Mobile App)-IMPS | Free Unlimited |

| From Jio Payments Bank to another Bank (Mobile App) – NEFT | Free Unlimited |

Jio payment bank FAQ

What is the minimum balance I need to keep in my Jio Payments Bank account?

There is no minimum balance requirement for Jio Payments Bank account.

Are there any charges/fees for using my Jio Payments Bank account?

There are no charges or fees for your Jio Payments Bank account.

How secure is my Jio Payments Bank account?

Your Jio Payments Bank account is protected from un-authorized access by requiring password and mPIN to access your account. This ensures that your account is secure even if you lose access to your phone.

In case you are transacting at any of our outlets, you will need to authenticate using your fingerprint, which will prevent any kind of unauthorised access to account.

Our IT systems are PCI DSS compliant, which ensures that your data is stored securely.

Can I withdraw money from any Jio Point or do I need to visit the home outlet?

You can withdraw money from any of the Jio Points across India.

What is Jio Payments Bank PPI?

Jio Payments Bank Prepaid Instruments is a safe and secure way to make digital payments across physical and online channels. You can make instant bill payments, do mobile/DTH recharges, pay at thousands of online & physical stores, and much more.

What are the benefits of using Jio Payments Bank PPI?

By registering for Jio Payments Bank PPI, you would gain access to a variety of services, which include:

• Secure cash-free transactions anytime from anywhere

• Securely store all your credit/debit cards for convenient and faster payments

• Make in-store and online payments across a variety of merchants

• Pay bills and recharge mobile/DTH using a single app

• Get great offers, deals and coupons from top brands and also from your neighbourhood stores

Who all can I pay to using Jio Payments Bank PPI?

You can pay:

• For all your Jio Services

• At all your neighbourhood stores (big and small), restaurants, shopping malls, college canteens, clinics, hospitals etc.

• On-line at e-commerce websites and also through the mobile app option offered by many online merchants.

• For utility bill payments like post-paid mobile connections, electricity, gas, landline and also insurance premiums.

• For prepaid mobile recharges & DTH connections

• For charity at National Association of Blind, Siddivinayak Trust, CRY etc.

Jio UPI FAQ

Is there any limit on transactions performed through Jio UPI ID? (OR) What is the minimum and maximum limit of money transfer and number of transactions through Jio UPI?

If you are registering for Jio UPI services for the first time or performing device binding after changing your SIM or device, the limits applicable within 24 hrs of the 1st transaction are:

Within 24 Hours of performing 1st Jio UPI Transaction

| Details | Limit | Send | Receive |

|---|---|---|---|

| Amount Limit | Minimum Transaction Amount | Rs. 1 | Rs. 1 |

| Amount Limit | Maximum Transaction Amount | Rs.5000 | Rs.5000 |

| No of Transactions limit | Minimum Number of Transaction per day(irrespective of the number of Banks linked to your Jio UPI ID) | No limit | No limit |

| No of Transactions limit | Maximum Number of Transaction per day (irrespective of the number of Banks linked to your Jio UPI ID) | 5 | 5 |

What is the Jio UPI tab in MyJio? What is it used for? (OR) What kind of transactions can I perform using Jio UPI?

We have introduced BHIM Jio UPI functionality in MyJio app, by using this functionality you can create your own a Jio Jio UPI handle by linking any Savings, Current or Overdraft account to it and using it as a payment mode for performing transactions. You can perform various transactions using a Jio Jio UPI handle like instant money transfer from 1 bank to another, Bill Payment, Recharge and so also pay merchants who accept Jio UPI as payment mode.

How many Bank accounts can I link with MyJio?

There is no limit on the number of bank accounts that you can link with MyJio. However please assure that the bank account that you are trying to link to MyJio should be linked with the mobile number that was used while creating the Jio UPI Account. As Jio UPI fetches the bank account from the mobile number that was used while creating the Jio UPI account.

What is Jio UPI PIN?

The Jio UPI PIN is a 4 or 6-digit pin that you can create during your first time registration with MyJio Jio UPI.

This PIN is unique to your bank account and not to your mobile number or Jio UPI handle.

The length of the PIN is bank specific and is not decided by MyJio.

Jio UPI PIN is very confidential as it is used to authenticate all your Jio UPI transactions, hence do not share it with anyone.

Jio money FAQ

JioMoney is a safe and secure way to make digital payments across physical and online channels. You can make instant bill payments, do mobile/DTH recharges, pay at thousands of online & physical stores, and much more. You can also link your cards and bank accounts with JioMoney.

By registering for JioMoney, you would gain access to a variety of services, which include:

- Secure cash-free transactions anytime from anywhere

- Securely store all your credit/debit cards and bank accounts for convenient and faster payments

- Make in-store and online payments across a variety of merchants

- Transfer funds to other JioMoney users and to bank accounts

- Pay bills and recharge mobile/DTH using a single app

- Get great offers, deals and coupons from top brands and also from your neighbourhood stores

Any person aged above 10 years is eligible to hold a JioMoney account.

Your JioMoney account is 100% secure. JioMoney stores your sensitive information on the most secure servers, using world-class security procedures and cutting-edge technologies to ensure that your data is theft-proof. These credentials are not disclosed to anyone when you pay through JioMoney.

We however request you not to share your mPIN and password details with anyone over the phone, email, SMS or in-person for further safety of your account.

Even if you lose your phone, your money is 100% safe. Nobody can access your JioMoney account, since only you can do so through your password and 4-digit mPIN. JioMoney locks your account for your own safety after 3 consecutive incorrect mPIN attempts. If you suspect unauthorized activity in your account, you can also suspend your JioMoney account and block payments by calling our customer service at 1800-891-9999 (toll-free) or write to care@jiomoney.com

Any customer with a valid mobile number, registered with any telecom operator can sign-up with JioMoney

You may download JioMoney from the Android Playstore or from the Apple Appstore.

You can download and install JioMoney from https://www.jiomoney.com . Start the app to see the registration page and follow the simple steps to create your account.

As of now JioMoney offers minimum KYC account. You may load up to Rs 10000 a month and spend up to Rs 10000 a month with this account. Also, you may load a maximum of Rs 1 lac in a financial year. Fund transfer to another person or bank account is not allowed with this account.

There are no charges for using JioMoney.

There is no expiry date for your JioMoney account. Your account is valid till the time your registered mobile number is active.

Each person can hold only one JioMoney account as per the Reserve Bank of India (RBI) regulations.

You can load money to your JioMoney account through Net Banking, credit card / or debit card.

You can link your bank account or credit/debit cards by logging into the JioMoney app and clicking “Add card/Bank account” under the Manage Accounts section.

In the unlikely event of a transaction failure, the deducted amount will be refunded back to the source account or card.

No, there is no expiry period for the money in your JioMoney account for now.

You can pay:

- For all your Jio Services

- At all your neighbourhood stores (big and small), restaurants, shopping malls, college canteens, clinics, hospitals etc.

- On-line at over 50,000 e-commerce websites like BookmyShow, Yatra, Burrp etc. and also through the mobile app option offered by many online merchants.

- For utility bill payments like post-paid mobile connections, electricity, gas, landline and also insurance premiums.

- For prepaid mobile recharges & DTH connections

- For charity at National Association of Blind, Siddivinayak Trust, CRY etc.

JioMoney is available as a payment option at more than 50,000 e-commerce websites like BookmyShow, Yatra, Burrp etc. And also through the mobile app option offered by many online merchants. You will see JioMoney option on the payments page of the e-commerce website/mobile app; just select JioMoney and finish your purchase.

Simply choose ‘Pay at Shop’ in your JioMoney app and the merchant will do the rest.

You will see the success page with transaction details. You will also receive an SMS on your registered mobile number and e-mail (if registered). You can also view your recent transactions in the transaction history section of your app.

You will see the success page with transaction details. You will also receive an SMS on your registered mobile number and e-mail (if registered), whenever you send/receive money. You can also view your recent transactions in the transaction history section of your app.

JioMoney locks your account for your own safety after 3 consecutive incorrect mPIN attempts. In order to unlock your account please contact JioMoney customer care at 1800-891-9999 (toll-free) or write to care@jiomoney.com

To set a new mPIN, click on the “Forgot your mPIN” option available on the JioMoney app and follow onscreen instructions.

You can give us feedback from your JioMoney app itself. Just click on the JioMoney icon on the top-right corner in your app and then select ‘Report Issue’. Alternatively, you can also contact the JioMoney customer care at 1800-891-9999 (toll-free) or write to care@jiomoney.com

Your JioMoney balance will be displayed on the home screen when you login to your account.

Your JioMoney transaction history will be displayed by clicking ‘>’ next to your balance on the home screen when you login to your account in JioMoney app.

You can update your profile information from the Account Settings (top right corner in Android & bottom drawer in iOS) on the JioMoney app. For changing information like phone number, address etc., you need to upload relevant documents in JioMoney app.

Visitors Also Searched For get all their queries solved:-

- Jio payments bank launch date

- Jio payments bank app

- Jio payments bank ltd

- Jio payments bank interest rates

- Jio payments bank CEO

- Jio bank interest rate

- Jio payments bank recruitment

- Jio payments bank headquarters